Authors: Ben Hartley (director), Luke Sefton (associate)

Important: Please note that this article is now out of date. These forecasts were published in early December, shortly before the existence of multiple COVID-19 variants was known, and the third national lockdown was brought into force as a result of spiralling infection rates during that month. We are however continuing to update our models in line with new data being released by the Office for National Statistics (ONS), the implications of which we share here:

Elderly care home COVID-19 update: 2 April 2021

Current picture:

- Weekly elderly care home deaths (1,471) are now well below 5-year weekly average (2,138), suggesting the second wave of the pandemic in England is now effectively over.

- The second-wave peak in weekly elderly care home deaths occurred week ending 29th January 2021, with 3,846 elderly care home deaths. This was approximately 50% lower than the first wave peak in weekly elderly care home deaths of approximately 7,587, which occurred week ending 24th April 2020.

Short-term view:

- Pandemic occupancy low-point estimated at 78.8% in June 2020.

- New admissions critical to occupancy recovery.

- Admissions to be at 25% lower than usual until April 2021, before pent-up demand combined with summer low deaths drives recovery.

- Earliest return to pre-pandemic occupancy levels of 87.3% now possible in May 2022.

Original article: December 2020 (now out of date)

Quick links

- Background

- Revisiting our original forecasts (April 2020)

- New Carterwood forecasts: December 2020

- Conclusions

Background

In April 2020, during the peak of the pandemic, we produced a set of forecasts on the potential longer-term impact on mortality rates and future occupancy levels within elderly care homes in England.

Having since endured two national lockdowns, layers of varied regional measures and controversy over tiered recoveries, the nation now faces a December like no other, with arguments raging about the degree of control pre- Christmas and the degree of relaxation to be allowed over the festive period in a bid to stave off a predicted third wave in the early New Year.

The challenges facing wider society have been even more acutely felt in the social care sector. A newly approved vaccine offers tantalising hope of a return to normality, while elderly care home occupancy continues to labour well below historic averages and operational challenges regarding testing and the facilitation of visits abound. This feels like a critical juncture in the sector’s recovery, so we believe this is the right time to return to our forecasts and reassess the picture in the light of the latest available information.

We recognise the enormous sensitivity of the subject matter we are dealing with. Behind the sterile statistics are individuals and families – both those being cared for and those doing the caring, as well as their families and friends. They have endured not just the medical challenge but stress, isolation, loneliness and, of course, bereavement. In delivering our analysis about the commercial implications of the pandemic, we are only too aware of its greater human cost. We are in awe of care providers and their frontline staff who have been doing such sterling work in unbelievably difficult circumstances. We also want to offer our condolences to all those who have lost loved ones in care homes, and offer our sympathy to those who have suffered in other ways during this period.

As analysts, our job is to step back from the emotion of the situation and look dispassionately at the facts and try to work out what we think the data is telling us. That’s what we did in April and, on the whole, our predictions were more right than wrong. Now, with more data at our disposal and recent good news regarding vaccine approvals, we hope that our updated forecasts will offer some encouragement about the path to recovery for care providers and others involved in the sector, with our model suggesting a best-case return to pre-pandemic occupancy levels by November 2021.

Revisiting our original forecasts (April 2020)

Our April report pulled together available data, intellectual resources and market analysis tools, to make predictions as to the likely impact of the pandemic on the sector. Before we present our updated forecasts, it’s important to briefly assess how we did with our initial analysis.

Predictions are a perilous game and so it’s no surprise we weren’t 100% right. As you can see in the table below, we over-estimated the number of elderly care home closures that would take place, and predicted a second-wave spike in elderly care home mortalities that has, fortunately, not yet come to pass. We did, however, quite accurately predict the shape and intensity of excess deaths and associated measures such as occupancy from the peak of the pandemic and through the summer. You can view our original April research here, and our analysis of what we got right and wrong here.

| What we got right | What we got wrong |

|---|---|

| • We forecast that occupancy would fall from a pre-pandemic average of 87.3% to a low point nationally of just over 79%. There is, as you would expect, variation between individual operators, but the vast majority of our clients have confirmed that the size of this forecasted reduction was accurate, even if the occupancy starting point varies. | • Whilst we predicted the start of the second wave to within one week in September in terms of the general population and case numbers, the expected mortality rate increase in the care home population has not materialised in the pattern and quantum predicted. Thankfully, the total forecasted net deaths have been much lower than forecast as a result. |

| • We predicted the peak, the quantum and trajectory of the tail end of the first wave’s curve accurately at a time when the trend was continuing upwards on an exponential basis. | • The number of care home closures has been significantly lower than expected. |

| • We forecast that deaths would fall below historic 5-year levels once the first wave was over, due to the accelerator effect of very elderly care home population. | |

| • We suggested there would be an inevitable referral lag but also pent-up demand, which on balance would see occupancy start to gradually improve to just over 80% over the 6 months since the first wave ended. | |

| • We predicted the start of the national “second wave” to within one week - starting in early September. |

We are naturally relieved that actual mortality rates have been lower than forecasted. We have always acknowledged the sheer grit and determination of those that run elderly care homes, but we have to confess that the extent to which operators have been able to confront the unbelievable pressures of the last 9 months has exceeded our already high expectations.

New Carterwood forecasts: December 2020

Key points

- 27,982 total excess elderly care home deaths during the pandemic when compared to the 5-year historic average – assuming one additional outbreak wave until the vaccine becomes widely available.

- Occupancy levels forecast to recover to pre-pandemic level of 87.3% in November 2021 at the earliest.

- The occupancy low point is estimated at 78.8%, reached in June 2020.

- Total elderly care home bed capacity will continue to decline to December 2024, with 35,700 existing beds lost and 19,700 beds gained from new development.

- Bed quality over the next 5 years will gradually rise, as follows: En-suite / market standard – 72.2% to 76.4%; Wetrooms – 26.2% to 32.1%.

- The national shortfall in supply levels of market standard beds will increase to between 57,300 and 64,300 beds by December 2024.

- The national shortfall in supply levels of wetroom beds will increase to between 221,600 and 228,600 beds by December 2024.

If you would like to request a copy of our full research report in PDF format, please contact Tom Hartley (director) on tom.hartley@carterwood.co.uk or 07715 495062.

Elderly care home mortalities: A less severe second wave

Preparing this report has coincided with a sustained increase in the number of care home mortalities. Is this a lagged second wave just starting to come through? If this is the case, what will be its size and shape and how will it differ from the first one? What is going to happen over the winter, which traditionally sees a spike in mortalities in a non-COVID normal year?

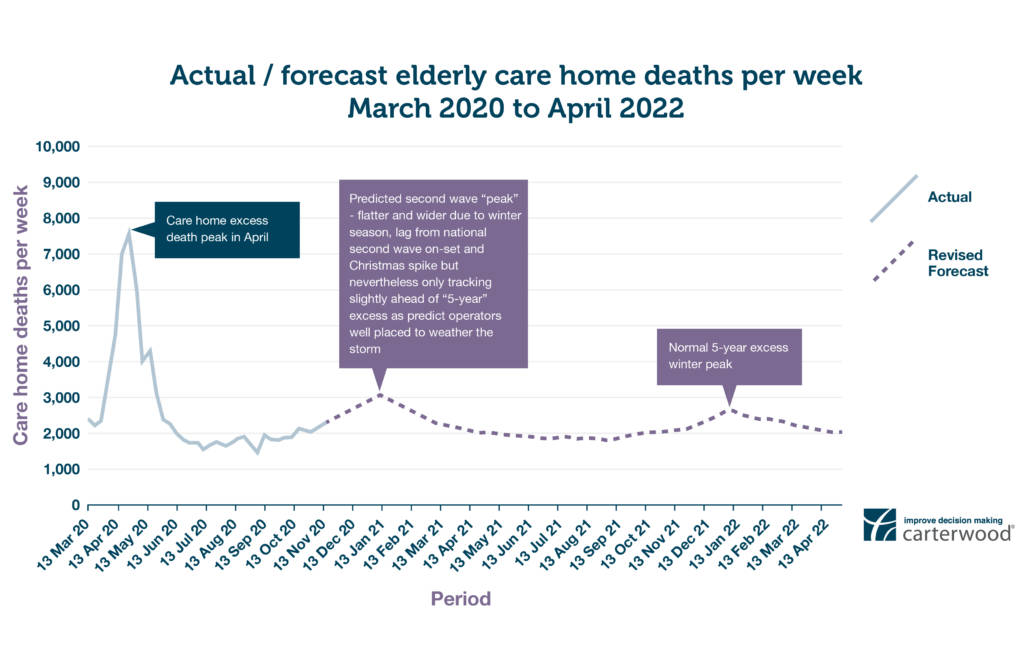

The chart below shows actual care home mortalities across England to 13 November 2020 (ONS), followed by our prediction of the trajectory they will take over the coming 18 months.

Figure 1: Actual / forecast care home deaths per week March 2020 to April 2022 (view hi-res in new tab)

We have assumed the extension of the current wave, in terms of outbreak pattern. It remains to be seen how quickly the recently approved Pfizer vaccine will be rolled out – given the operational challenges involved – and how soon the Oxford and Moderna vaccines receive MHRA approval. Naturally, we hope for that process to be as rapid and frictionless as possible.

The curvature of the second wave in our model is flatter and wider than that of the first wave. This reflects the following contributing factors:

- the impact of excess winter death rates between November and March

- a lag between the onset of the second wave nationally and its translation into care home mortalities

- a projected holiday-season spike

- earlier than anticipated vaccine roll-out.

However, overall, we believe this second wave will be significantly less severe than the first, with policies and procedures implemented earlier in the year having been shown to protect elderly care home residents.

We are therefore forecasting a total of 27,982 excess elderly care home deaths during the COVID-19 outbreaks compared to historic average annual elderly care home deaths. This represents a significant and very welcome reduction in overall excess deaths from our original forecast of 36,442, though of course, every excess death is one too many.

Occupancy: Best-case return to pre-pandemic levels by November 2021

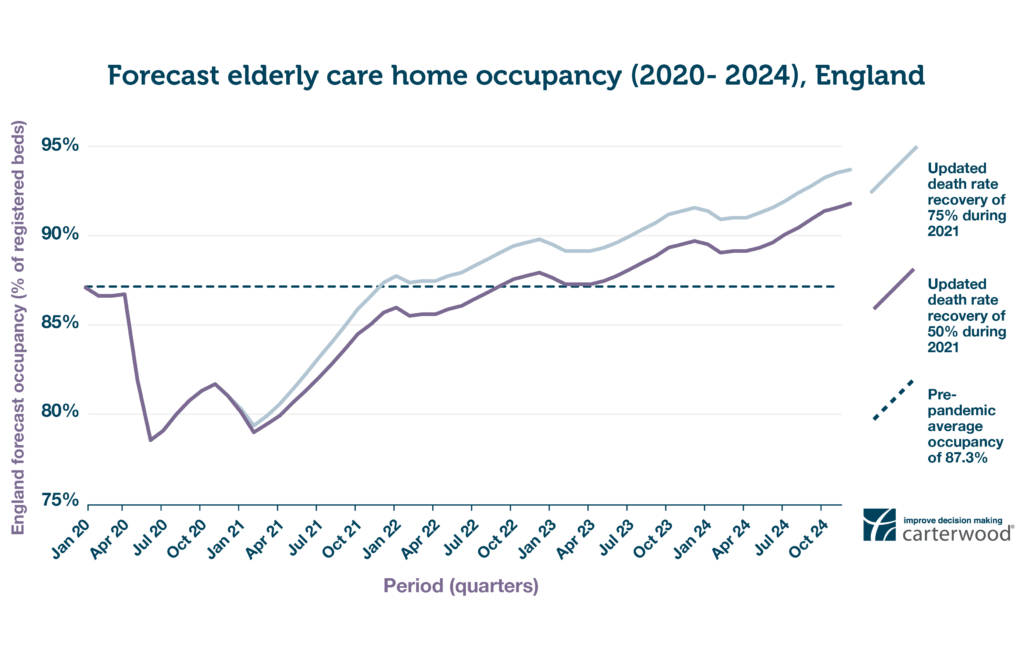

In the absence of a definitive, independently audited measure of total sector occupancy in England today, we must rely on estimates based on feedback from operators and sparse publicly available information. We peg current occupancy levels at between 80% to 82%, with a trend of slow recovery from a low point of 78.8% at the peak of the crisis.

The critical drivers for occupancy recovery are:

- Mortality/discharge rates: trend against “typical” non-COVID years

- Admission rates: how quickly admissions pick up in light of latent/pent-up demand vs. caution over placement

We see the next few months as remaining challenging, with occupancy falling slightly away from current levels as care home mortalities increase along the lines of the second ‘peak’ outlined in Figure 2 below. A more sustained recovery will manifest itself during 2021, driven by pent-up demand and the slow but ultimately decisive impact of the vaccination programme that we now know should take place in Q1.

Figure 2: Forecast care home occupancy (2020 – 2024), England (view hi-res in new tab)

Overall, the good news is that we believe average occupancy across the sector in England could return to pre-pandemic levels of 87.3% as soon as November 2021.

Demand and supply: a stable and resilient picture over 5 years

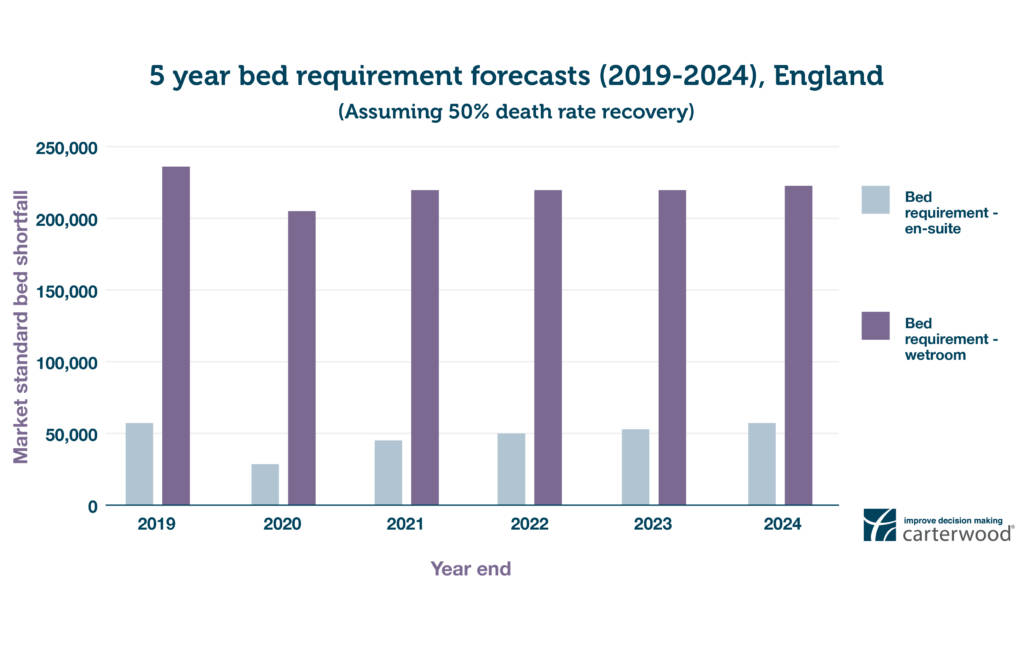

We have analysed the sector bed requirement for the period December 2020 to December 2024 – subtracting the supply of elderly care home beds (existing and planned stock) from the current level of demand (market size).

In our original April forecasts, we overestimated the number of elderly care home closures that would take place. However, regrettably, we still believe that some of those closures will materialise in 2021 – leading to a shrinking of current supply.

Our model assumes that the currently monthly closure rate of approximately 600 beds per month will continue until May 2021 (when government support is anticipated to be removed and additional tax measures are introduced) – following which, we predict they will increase by 40% to around 850 per month until April 2022, before returning to pre-COVID rates thereafter. Overall, we expect a total loss of 35,700 existing elderly care home beds between November 2020 and December 2024 due to a combination of financial and staffing pressures, localised COVID-19 impact and asset obsolescence.

We have assumed no change to new bed additions, as there is no evidence to the contrary, and our model assumes a net bed loss across the market equivalent to pre-COVID levels of around 3,000 beds per annum from mid-2022 onwards.

Figure 3: 5-year bed requirement forecasts (2019–2024), England (assuming 50% death rate recovery) (view hi-res in new tab)

In terms of supply quality, homes with level-access wetrooms are the only option that allow for the washing and bathing elements of self-isolation to be carried out over a meaningful length of time. Rising market expectations will accelerate the trend towards this accommodation type over the coming years.

Some 26.8% of current stock still provide no en-suite of any kind, let alone one with wetroom facilities. Surprising as this is, until there is structural or regulatory change, the pace of asset upgrading will remain slow. This, however, is essential, and we believe that the investment case for new developments in the sector in a post-COVID era is as strong, if not stronger, than before the pandemic.

Taking all the above into account, the next 5 years paints a stable and resilient picture for care home demand.

The long-term demographic profile remains positive and the sector has been remarkably resilient in the face of material levels of bed loss over the past few decades. We estimate a shortfall of between c. 57,300 and 64,300 market standard beds by December 2024, and c. 221,600 and 228,600 wetroom beds, depending upon the death rate recovery rate adopted.

Conclusions

It is heartening that the picture, while still challenging, is nevertheless more optimistic for the short and mid-term future of the sector.

We are pleased to forecast that excess deaths in elderly care homes will be significantly lower than previously expected, while acknowledging that this brings no comfort to those families that have suffered the tragic loss of loved ones to this virus during the course of the pandemic.

For those involved in building, running, and funding elderly care homes, we hope to be proved right in predicting that while occupancy will continue to fall slightly during the winter months, we will see a sustained recovery during 2021.

In the longer term, we believe there will be an acceleration towards wetroom accommodation and, in purely capital terms, it’s clear that the investment case for new developments is possibly stronger than ever.

For all of us involved in the sector – whether directly in the provision of care or elsewhere in the supply chain – our collective hope must be that the extraordinary efforts of those in the sector will eventually be rewarded by long-overdue social care reform.

In the short-term, we would like to raise awareness of two organisations: First, Championing Social Care, which is doing fantastic work to raise awareness and recognition of social care generally; and the Care Workers’ Charity, which supports the care workers who look after the most vulnerable in our society.

The fortitude shown by those who manage and work in our elderly care homes has been nothing short of magnificent, and they deserve our support both now and in the future.

If you would like to request a copy of our full research report in PDF format, or you would like details of our methodology in conducting this analysis, please contact Tom Hartley (director) on tom.hartley@carterwood.co.uk or 07715 495062.