Research recap:

- 2 July: Forecasts updated to include another two weeks of ONS data

- Total excess care home deaths reduces very slightly

- Occupancy low point increases slightly from 79.0% to 79.1%

- 18 June: Forecasts updated to include another two weeks of ONS data

- Very small increase in excess care home deaths

- All other metrics unchanged

- 04 June: Forecasts updated to include another two weeks of ONS data

- Slight increase in excess care home deaths

- Other metrics largely the same

- 21 May 2020: Forecasts updated to include an additional two weeks of data

- Significant reduction in excess care home deaths

- Increased rate of care home closure

- Earlier return to pre-pandemic occupancy levels

- 13 May 2020: Initial COVID-19 forecasts published

Director, Ben Hartley, talks about the key changes and explains why we will continue to monitor the data throughout the pandemic.

The first point to stress is that while our analysis is an academic and business exercise, we remain acutely aware of the human cost behind the figures and acknowledge the extraordinary difficulties experienced by care home residents and their families, as well as by operators and carers delivering front-line services.

Media and political scrutiny remain intense and it would be easy to use our findings to attribute criticism or praise. But the job of the analyst is to be dispassionate, to present the facts and to let the conclusions speak for themselves.

If you’d like to discuss our findings or get a copy of the research in PDF form, please get in touch with Tom Hartley (Director) on tom.hartley@carterwood.co.uk or 08458 690777.

Updated dataset – 2 July 2020

The following new data has been included in this 2 July update to our forecasts: –

- 2 new weeks of ONS actual death rate data for England incorporated into model.

- The data is based upon ONS registrations (two weekly lag, but the best quality data) up until 19 June (data released on 30 June).

- We have reviewed the more up to date (but less accurate) CQC & NHS data sources to assist in predicting trends to help our forecasting model.

The addition of this data has not materially changed our forecasts from the 18 June 2020 update:

- As predicted, mortalities fell in line with 5-year average levels in mid-June, confirming that COVID-19 has now come ‘under-control’ compared to historic death-rate norms.

- Total predicted COVID-19 excess deaths have reduced very slightly to 32,902 from 32,926

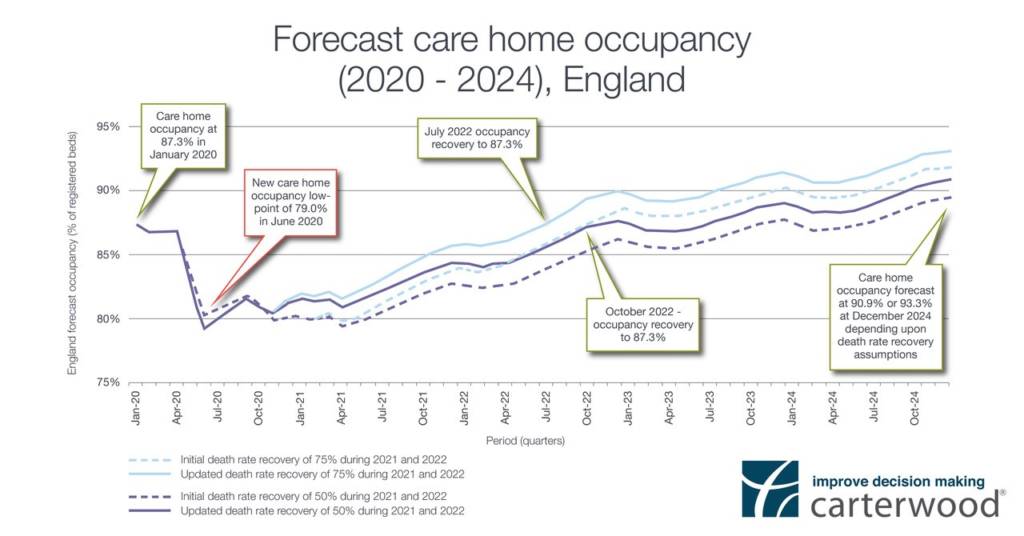

- Return to pre-pandemic occupancy levels of 87.3% remains forecast for between July and October 2022

Updated dataset – 18 June 2020

The following new data has been included in this 18 June update to our forecasts: –

- 2 new weeks of ONS actual death rate data for England incorporated into model.

- The data is based upon ONS registrations (two weekly lag, but the best quality data) up until 5 June (data released on 16 June).

- We have reviewed the more up to date (but less accurate) CQC & NHS data sources to assist in predicting trends to help our forecasting model.

The addition of this data has not materially changed our forecasts from the 4 June 2020 update:

- Care home deaths followed the predicted trajectory of our model almost identically since our last update (4 June)

- Total predicted COVID-19 excess deaths have increased very slightly to 32,926 from 32,853

- We predict that deaths will fall in line with 5-year average levels by end of next week, indicating that COVID-19 is ‘under-control’ compared to historic death-rate norms. (Please note, we are in no way suggesting that the crisis is over)

Updated dataset – 4 June 2020

The following new data has been included in this 4 June update to our forecasts: –

- 2 new weeks of ONS actual death rate data for England incorporated into model.

- The data is based upon ONS registrations (two weekly lag, but the best quality data) up until 22 May (data released on 2 June).

- We have reviewed the more up to date (but less accurate) CQC & NHS data sources to assist in predicting trends to help our forecasting model.

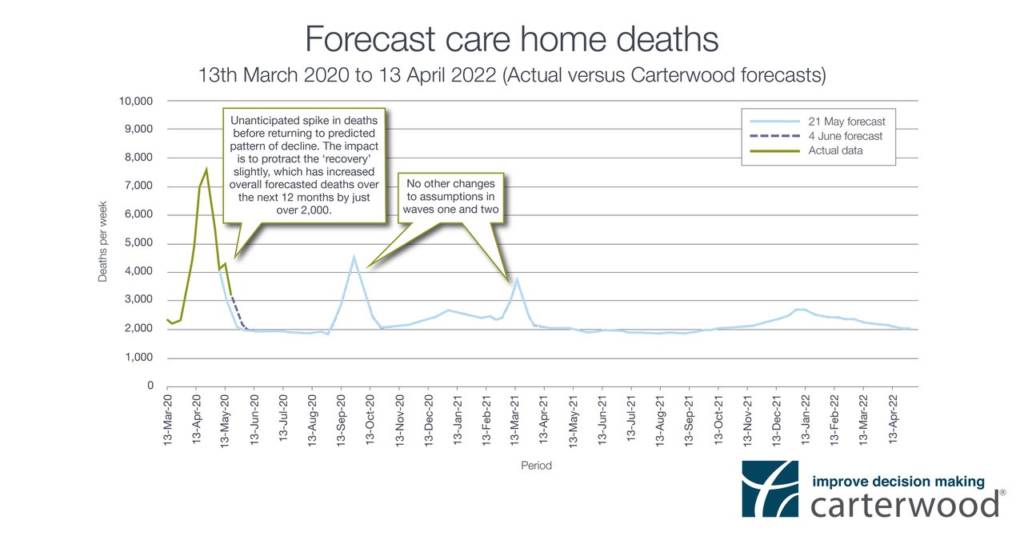

This data has not dramatically changed our forecasts from the 21 May 2020 update, but there has been a slight increase in forecast care home deaths that it is important to draw attention to.

Carterwood commentary

Please note, the commentary below was last updated on 4 June 2020. Updates to our dataset since then have not significantly altered our forecasts, so the analysis below remains current. Any subtle changes to specific numbers are detailed above in the section ‘Updated dataset – 18 June 2020’. If you would like a member of our team to share the latest charts with you, please get in touch with Tom Hartley on tom.hartley@carterwood.co.uk or 08458 690777.

Slight increase in excess deaths

Forecasted excess total elderly care home deaths during the COVID-19 outbreaks (to April 2021), when measured against the 5-year historic average, have risen from a predicted 30,635 to 32,853.

This change has been driven by an unanticipated spike in deaths around the 13th May, with the numbers then reducing at our expected rate shortly after. The impact of this is an increase in overall forecasted deaths over the next 12 months by just over 2,000, and a slight delay in recovery to pre-pandemic occupancy levels.

Slight delay in return to pre-pandemic occupancy levels

As a result of the mini-spike in deaths we see above, the occupancy low point has been lowered from our previous figure of 79.5% to 79.0%, but will be reached in the same month – June 2020 – as we previously forecasted.

Furthermore, our previous report on 21 May 2020 forecast that occupancy would return to the pre-pandemic level of 87.3% some time between July and October 2022. This level is now predicted to be achieved very slightly later – between July and October 2022.

Forecasts and predictions

We all know that predicting the future is challenging, but based upon our assumptions, the analysis also points to the following issues which warrant further consideration.

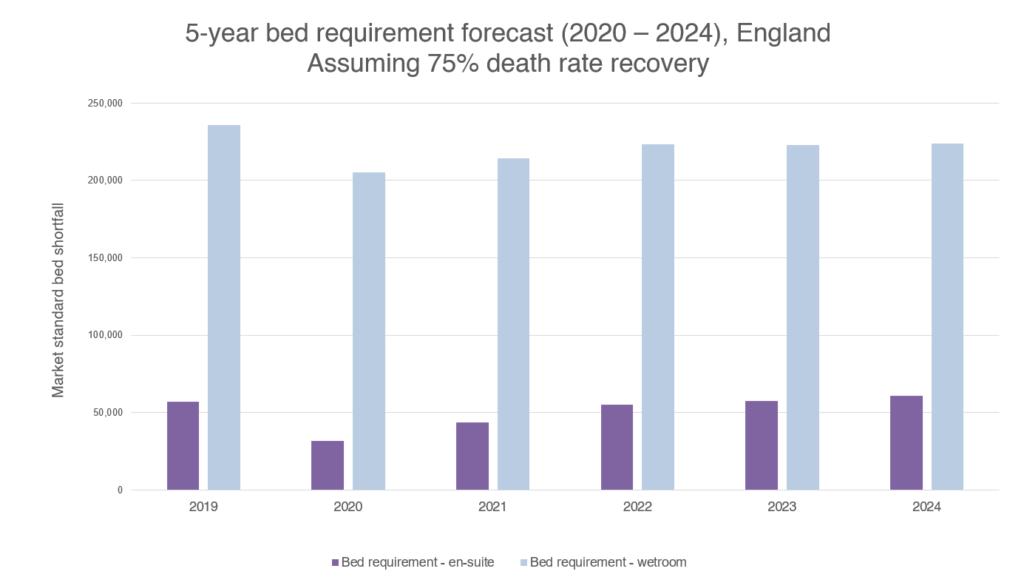

Quality of stock

Not far short of one third of the beds in England (29.5%) are not “market-compliant” i.e. without en-suite WC and wash hand basins.

In a post-COVID era, market expectations (both self-funded and local authority) are likely to rise and the effectiveness of a care home to enable residents to effectively self-isolate will be called into question.

It remains to be seen if there will be any regulatory changes to spatial/environmental requirements for care homes and any changes are likely to take some time to work their way through the system. Nevertheless, homes with level access wetrooms are the only accommodation option that enable the washing and bathing elements of self-isolation to be carried out over a meaningful length of time. The graph below shows the extent of the shortfall of wetroom accommodation, which makes for a strong case for investment in the sector.

Self-funding market

Higher fees and greater profitability mean the private market is likely to be better insulated to withstand any short-term occupancy dips than providers operating on much tighter margins driven by local authority fee rates.

Although all homes are virus targets, high quality accommodation allows residents to more effectively socially distance and thereby minimise the risk of outbreaks. There may even be potential for private operators to charge premium fee rates for ‘COVID-free’ environments.

Data about resident recovery within care homes will be critical to help restore confidence that outbreaks can be managed. The potential reputational damage of the crisis cannot be ignored and winning back public confidence will be critical in determining the speed of new admissions.

Anecdotal evidence and hard data reinforce our view that COVID outbreaks and severity will vary considerably from home to home and from region to region. Highly localised work will be needed to understand the true impact for individual areas.

Drawing conclusions

It might be a truism to say that “the only certainty is uncertainty”, but this has been a period like no other in living memory. Information will continue to percolate through and this will affect not just forecasts and predictions, but will also teach us lessons and direct us for the future.

If you’d like to discuss our findings or get a copy of the research in PDF form, please get in touch with Tom Hartley (Director) on tom.hartley@carterwood.co.uk or 08458 690777.

Sources: ONS, Laing Buisson, Public Health England, Tomorrow’s Guide, World Health Organisation and Institute for Health Metrics and Evaluation.