Author: Tom Hartley, director

The requirement to increase provision of specialist accommodation for older people is clear. By 2040, one in four people in the UK will be over 65, with that segment of our population having grown by 41% in 20 years to nearly 18m people. This is an enormous elderly demographic, with a wide range of accommodation needs.

While 2040 is clearly still some way off, given Carterwood are forecasting a shortfall in en-suite elderly care home beds of 55,000 to 65,000 by end-2024, and independent thinktank CSFI recently highlighted the chronic shortage of specialist older people’s housing, it’s clear that significant development is required if we are to provide for the future needs of the older members of our communities.

It’s against that backdrop that we are pleased to introduce our inaugural Carterwood Market Movers research, in which we celebrate those who are aiming to redress the supply and demand imbalance in the elderly care home and older people’s housing sectors with their new planned developments.

Our goal is to highlight the organisations that are poised to bring much needed new capacity to sectors that urgently need it.

Quick links:

- Our approach

- Meet our elderly care home Market Movers

- Meet our older people’s housing Market Movers

- In summary

- Methodology – What makes a Market Mover?

Our approach

Our Market Movers research ranks developers and operators by planning activity in the elderly care home and older people’s housing sectors over the 12-month period of 1 April 2020 to 1 April 2021.

For a full breakdown of our methodology, skip to the What makes a Market Mover? section at the bottom of this article.

Meet the elderly care home Market Movers

We’ve ranked our elderly care home Market Movers by the number of beds included in the planning applications that met our criteria (see What makes a Market Mover?). This enables us to see who is bringing the greatest capacity to the sector. For brevity (of sorts), we’ve also only included organisations with more than 100 elderly care home beds represented across their applications.

| Rank | Applicant | Applications | Beds | Average size (beds) |

|---|---|---|---|---|

| 1 | Frontier Estates Ltd | 16 | 1113 | 70 |

| 2 | LNT Group | 16 | 1056 | 66 |

| 3 | Barchester Healthcare Ltd | 14 | 707 | 62 |

| 4 | Hamberley Development | 9 | 617 | 73 |

| 5 | Simply UK | 8 | 554 | 68 |

| 6 | Care UK Nursing & Residential Care Services | 7 | 509 | 73 |

| 7 | Country Court Care | 12 | 500 | 68 |

| 8 | Cinnamon Care Collection Limited | 6 | 437 | 73 |

| 9 | Perseus Land & Developments | 6 | 398 | 66 |

| 10 | New Care | 5 | 336 | 67 |

| 11 | Liberty Properties Plc | 4 | 278 | 70 |

| 12 | Runwood Homes Ltd | 5 | 272 | 61 |

| 13 | Avery Healthcare Group | 4 | 272 | 68 |

| 14 | Yorkare Homes Ltd | 4 | 247 | 62 |

| 15 | Lawrence Land Limited | 3 | 243 | 81 |

| 16 | Urban Village Group | 3 | 218 | 73 |

| 17 | Berkley Care Group | 3 | 216 | 72 |

| 18 | Northcare Ltd | 3 | 212 | 71 |

| 19 | Hallam Land Management Ltd | 3 | 210 | 70 |

| 20 | Athena Construction Group | 1 | 205 | 205 |

| 21 | Tanglewood Care Services Ltd | 3 | 200 | 67 |

| 22 | Westgate Healthcare | 3 | 163 | 78 |

| 23 | Angela Swift | 2 | 160 | 80 |

| 24 | VOS Ltd | 1 | 160 | 160 |

| 25 | MACC Care | 2 | 154 | 77 |

| 26 | Charterpoint Ltd | 2 | 146 | 73 |

| 27 | Bellway Homes | 2 | 143 | 72 |

| 28 | Oakland Primecare | 2 | 143 | 72 |

| 29 | Montpelier Estates | 2 | 140 | 70 |

| 30 | Care Concern | 2 | 139 | 70 |

| 31 | Crown Care Group | 2 | 126 | 63 |

| 32 | Highwood Group | 2 | 120 | 60 |

| 33 | CARE (Little Court) Ltd | 1 | 120 | 120 |

| 34 | Prime Life Ltd | 2 | 113 | 57 |

| 35 | Kingsley Healthcare Limited | 3 | 107 | 48 |

*Average size only relates to new schemes; extensions are excluded from this datapoint, but are included in the total beds number

As you can see, two organisations led the way during the 12-month period in question. Frontier Estates Ltd are our #1 Market Mover in the elderly care home sector, with 1,113 beds spread across 16 applications during the period in question.

Extremely close behind are LNT Group, with 1,056 beds across 16 applications.

Congratulations to both on their ambitious growth plans during 2020 and early 2021. We caught up with both of them to get their thoughts.

Sam Rous, development director, head of healthcare, Frontier Estates Ltd, said:

“Frontier has had a very active year acquiring and securing planning permissions for a number of later living developments. We’re really proud of the relationships we’ve forged with our trusted partners and this continued support is allowing us to deliver high quality, bespoke schemes across the UK.

The way in which care is procured and delivered continues to change and we’re actively responding to this, whether by employing modern methods of construction, our sustainability credentials or even the very nature of the facilities themselves and how people can access care. The sector has some exciting times ahead and we’re ready to be part of it.”

Nick Broadbent, development director, LNT Care Developments, said:

“The last 12–18 months have further reinforced the overwhelming need to improve care home stock in the UK. LNT built 14 state of the art care homes throughout the last year, notwithstanding the wider challenges in the economy.

We will commence over 20 new developments in the current financial year and future demand pressures gives us significant confidence to continue our growth ambitions in the next few years.”

Despite Frontier and LNT clearly leading the way in this Market Movers list, it’s encouraging to see so many of the sector’s leading operators and developers represented in the planning pipeline.

Barchester, Hamberley, and Simply UK round out our top five, with a variety of familiar faces, such as Care UK, Country Court Care, Cinnamon Care Collection, Perseus Land and Developments, New Care, Liberty Properties, Runwood Homes, Avery Healthcare Group, Lawrence Land, and Tanglewood all featuring in the top 20.

It’s also heartening to see some new names, such as Urban Villages Group, high up the list and potentially set to bring much-needed new beds to the sector.

Regional breakdown

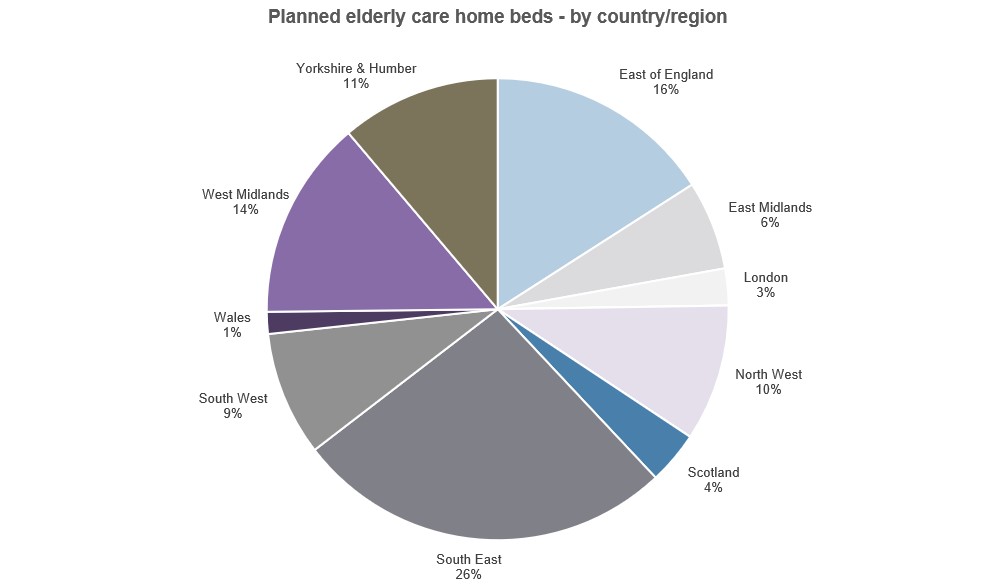

From the chart above, it’s clear where our Market Movers have been focusing over 2020/2021. The South East is the leading region for planned new beds, with high house prices underpinning the business case for the development of new homes in the region.

The East of England – another historically popular region for development – is the second most popular region, with 16% of new planned beds. However, it’s interesting to see that the West Midlands – a region we highlighted in our recent care home openings research as a core area of focus for operators – isn’t far behind here, with 14% of the planned new beds.

Meet the older people’s housing Market Movers

For the older people’s housing Market Movers, we’ve ranked by units rather than schemes, as again we believe this approach gives the best picture of new supply, given variations in scheme size across the sector. To keep the list manageable, we’ve also only included organisations with over 100 units represented across their applications.

| Rank | Applicant | Applications | Units | Average size (units) |

|---|---|---|---|---|

| 1 | McCarthy & Stone Management Services Ltd | 39 | 2140 | 55 |

| 2 | Audley Retirement | 7 | 1091 | 163 |

| 3 | Inspired Villages | 8 | 1031 | 138 |

| 4 | Churchill Retirement Living | 11 | 568 | 52 |

| 5 | Guild Living | 2 | 499 | 250 |

| 6 | Retirement Villages Ltd | 2 | 343 | 172 |

| 7 | Areli Real Estate Limited | 1 | 311 | 311 |

| 8 | Apache Capital Partners | 1 | 260 | 260 |

| 9 | Plutus Estates Ltd | 1 | 250 | 250 |

| 10 | Think Green Land Limited | 1 | 210 | 210 |

| 11 | Cornwall Council | 1 | 200 | 200 |

| 11 | TAYLOR WIMPEY UK LTD | 1 | 200 | 200 |

| 13 | YourLife Management Services Ltd | 3 | 167 | 56 |

| 14 | Avantage (Cheshire) Limited | 1 | 132 | 132 |

| 15 | ENGIE | 3 | 129 | 55 |

| 16 | Primetower Care Homes Poole Ltd | 1 | 126 | 126 |

| 17 | Castleoak | 1 | 124 | 124 |

| 18 | Berkeley Homes Ltd | 1 | 122 | 122 |

| 19 | Highwood Group | 1 | 120 | 120 |

| 20 | Adlington Retirement Living | 2 | 117 | 59 |

| 21 | Angle Property (Headley Court) LLP | 1 | 111 | 111 |

| 22 | Black Shu Ltd | 1 | 108 | 108 |

| 22 | Cooper Estates Strategic Land Ltd | 1 | 108 | 108 |

| 24 | Birchgrove | 2 | 107 | 54 |

| 25 | CAD Architects Limited | 1 | 105 | 105 |

| 26 | Elysian Development Management Limited | 1 | 103 | 103 |

As you can see, one Market Mover stands apart from the rest when it comes to planning activity during the period in question. McCarthy Stone had planning applications that represented 2,140 new units either validated or granted, which was almost double the number of units of the #2 Market Mover on our list, Audley Retirement.

We spoke to McCarthy Stone about their development focus for the future. John Tonkiss, Chief Executive of McCarthy Stone, said:

“We see strong and ongoing demand for high-quality retirement communities and are ramping up our planning and build programme in response.

This type of housing has proved its worth during the COVID-19 pandemic where thankfully we saw a significantly lower level of infection than in wider society. High-quality and well-located retirement communities also bring life back to high streets and help older people remain independent and safe in their own home, with companionship, care and assistance on hand as needed.

Given this and the ageing population, we are predicting a major increase in interest from consumers. We are looking to buy more than 60 sites a year, having bought more than 200 in the last four years – the most of any retirement developer in the UK. This includes sites for both our Retirement Living and Retirement Living PLUS (Extra Care) communities.

We look forward to making a positive difference to the lives of even more older people in future.”

As you might expect, the older people’s housing Market Movers list features a range of organisations, from the two largest developers in the sector in McCarthy Stone and Churchill Retirement Living, to specialist retirement community operators – which are well represented in the top 10 by Audley Retirement, Inspired Villages, Guild Living, and Retirement Villages.

Well-known sector stalwarts such as Castleoak and Birchgrove feature, as you’d expect, along with a variety of names that may be new to our readers.

Regional breakdown

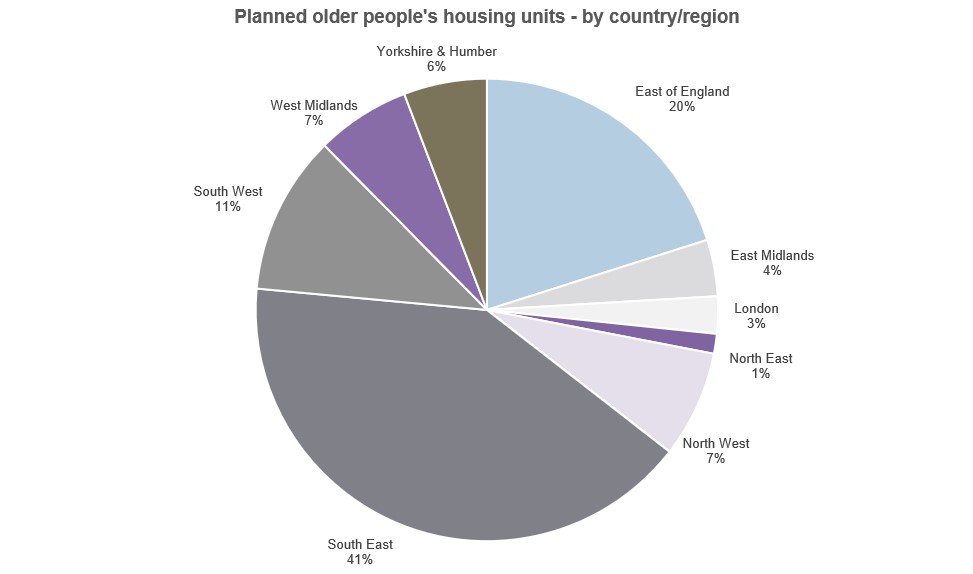

Looking at the regional distribution of the new planned units our Market Movers are looking to bring to market, it’s evident that historic trends in older people’s housing development are set to continue.

The South East and East of England combined account for 61% of the Market Movers’ planned new older people’s housing units, while only the South West gets into double figures for their share of planned units, at 11%.

In summary

There is an urgent need for increased development across the elderly care home and older people’s housing sectors. Provision of suitable accommodation simply has to keep pace with the needs of the older members of our communities.

However, matching supply to demand is clearly easier said than done. The two sectors we’ve assessed here face different but equally challenging barriers to increased development.

The elderly care home sector has suffered tremendously over the course of the COVID-19 pandemic, with an average occupancy reduction of 8% across the board and difficult operational challenges, from sourcing PPE and maintaining staffing levels, to implementing testing programmes and managing visiting procedures across multiple waves of the virus.

Operators have demonstrated incredible resilience and there are now encouraging signs that occupancy is recovering, and a degree of stability is returning to the sector. As this trend continues, we believe that development will be stimulated by the underlying shortfall in supply, and catalysed by a number of additional factors. First, there is significant overseas interest in investing in the UK elderly care home sector; Second, environmental and social governance (ESG) and sustainability is at the heart of decision-making when it comes to the built environment now – this means a trend towards new, purpose-built stock; Third, we are seeing more developers from the commercial property sectors including care as part of their future strategies.

The older people’s housing sector has had a very different COVID-19 experience over the last 15 months, with retirement communities in particular experiencing significantly lower infection rates than society in general. While this is cause for celebration, the sector as a whole faces structural issues that have for a long time stymied development.

Specialist older people’s housing is a broad catch-all for a sector that is evolving rapidly in terms of accommodation types and levels of care provision. The nuances of these models are not clearly understood by our planning system, which often makes it difficult to gain consent for new schemes, nor are they well understood by their target market – the older members of our communities – which inhibits demand.

Despite these barriers to development, there are grounds for real optimism in the older people’s housing sector. The Associated Retirement Community Operators (ARCO) is beginning to get real traction in its efforts to establish a Housing with Care Taskforce that can bring together key governmental cogs and remove the structural barriers outlined above. At the same time, investment is flowing into the sector – see BlackRock Assets’ £500m joint-venture with Audley Group, and the £200m joint-venture between Schroder Real Estate and Octopus Real Estate. At a time when sectors such as hospitality, retail, and serviced offices are struggling under the burden of the pandemic, the investment appeal of a sector as futureproofed as older people’s housing is clear.

On balance, we are optimistic about the development potential of both these incredibly important sectors. The underlying demographic trends are impossible to get away from, which necessitates an increase in specialist accommodation for older people with a variety of different needs.

We anticipate a significant increase in new care home beds and older people’s housing units being brought to market over the coming years. Our Market Movers programme will track and celebrate those that lead the charge.

Methodology – What makes a Market Mover?

Our Market Movers research ranks developers and operators by planning activity over a recent 12-month period: 1 April 2020 to 1 April 2021.

For a planning application to qualify for inclusion in this edition of the Carterwood Market Movers, it had to have been validated in the United Kingdom and:

- Have been granted permission during the period 1st April 2020 to 1st April 2021 (please note: this includes applications validated prior to this period, but granted during it)

OR - Have been validated during the period 1st April 2020 to 1st April 2021, and still be pending a decision (please note: this includes pending appeals, but does not include refused applications with no appeals)

Other factors:

- Planning applications for both new schemes and extensions are included in the figures

- An elderly care home planning application is defined as: any applications for additional care home beds for the elderly that will be registered with a regulatory body (CQC, RQIA, SCI and CIW)

- An older people’s housing planning application is defined as: any applications for new units of older people’s housing, covering housing with and without care (falling in both C2 and C3 uses), including everything from age exclusive/sheltered housing to extra care/close care.

We decided to use the 12-month period from 1 April 2020 because, in our view, it makes sense to assess a period that was entirely affected by the COVID-19 pandemic, instead of using the whole of 2020, which would have 2–3 months of ‘normal’ business and 9-10 months of extremely different circumstances.

The data used to generate the Market Movers lists is sourced from Glenigan, Planning Pipe, and local authority planning websites, then vetted and checked by our expert data team. To ensure the accuracy of this research, we have reached out to developers and operators by email, asking for information on planning applications during the time period in question, and we have requested planning information from potential Market Movers via social media.

100% accuracy is difficult to achieve, but our sector-specialist team has worked extremely hard to ensure this research is as accurate as it can be. That being said, please let us know via info@carterwood.co.uk if you think there’s anything that’s not quite right.

*Carterwood’s Market Movers research was updated on 12/07/2021 to reflect planning application information provided to us by operators/developers after the original publication. This has slightly affected the ranking of some organisations in the elderly care home list.