Background

In April 2020, during the peak of the pandemic, we produced a set of forecasts about the potential longer-term impact of the COVID-19 pandemic on mortality rates and future occupancy levels within elderly care homes in England.

This analysis pulled together available data, intellectual resources, and tools, to make predictions as to the likely impact of the pandemic on the sector. Alongside the publication of our new December 2020 forecasts, it’s important that we assess how we did originally.

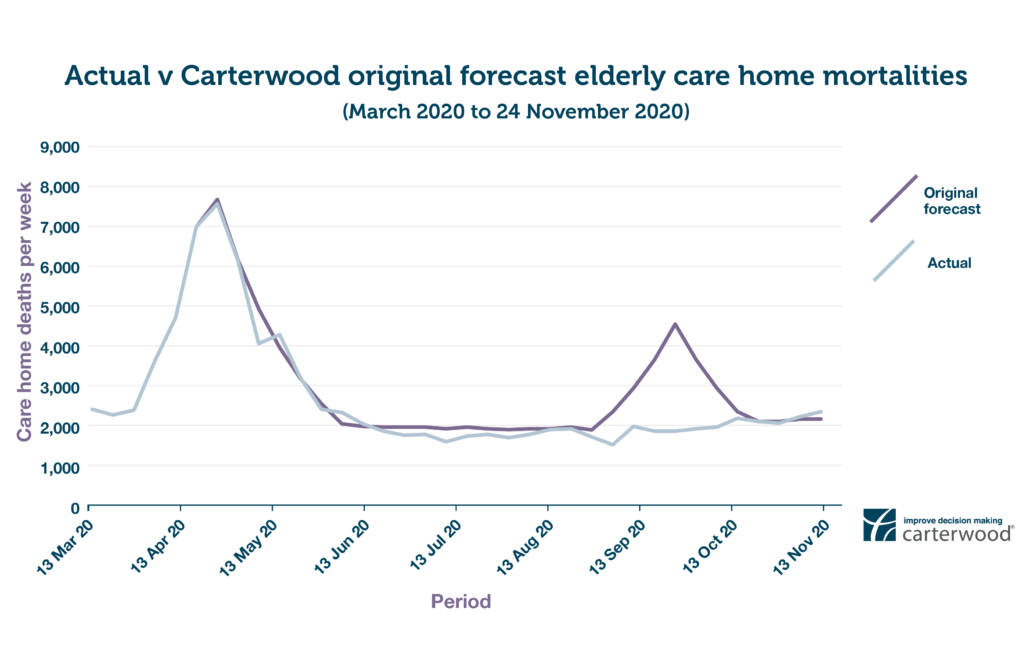

Predictions are a perilous game and so it’s no surprise we weren’t 100% right. As you can see in the table below, we over-estimated the number of elderly care home closures that would take place, and predicted a second-wave spike in elderly care home mortalities that has, fortunately, not yet come to pass. We did, however, quite accurately predict the shape and intensity of excess deaths and associated measures such as occupancy from the peak of the pandemic and through the summer. You can view our original April research here.

Before we get into what we got right and what we got wrong, it’s important to state that we recognise the enormous sensitivity of the subject matter we are dealing with. We work closely with care providers and representative organisations across the sector. We understand the terrible strain that has been placed upon residents, their families, and those that care for them. Our goal is not to ignore the human cost of the last 9 months, but to assess what its impact is on the long-term viability of the sector as a whole.

| What we got right | What we got wrong |

|---|---|

| • We forecast that occupancy would fall from a pre-pandemic average of 87.3% to a low point nationally of just over 79%. There is, as you would expect, variation between individual operators, but the vast majority of our clients have confirmed that the size of this forecasted reduction was accurate, even if the occupancy starting point varies. | • Whilst we predicted the start of the second wave to within one week in September in terms of the general population and case numbers, the expected mortality rate increase in the care home population has not materialised in the pattern and quantum predicted. Thankfully, the total forecasted net deaths have been much lower than forecast as a result. |

| • We predicted the peak, the quantum and trajectory of the tail end of the first wave’s curve accurately at a time when the trend was continuing upwards on an exponential basis. | • The number of care home closures has been significantly lower than expected. |

| • We forecast that deaths would fall below historic 5-year levels once the first wave was over, due to the accelerator effect of very elderly care home population. | |

| • We suggested there would be an inevitable referral lag but also pent-up demand, which on balance would see occupancy start to gradually improve to just over 80% over the 6 months since the first wave ended. | |

| • We predicted the start of the national “second wave” to within one week - starting in early September. |

We are naturally relieved that actual mortality rates have been lower than forecasted. We have always acknowledged the sheer grit and determination of those that run elderly care homes, but we have to confess that the extent to which operators have been able to stave off the unbelievable pressures of the last 9 months have exceeded our already high expectations.

FIGURE 1: FORECAST CARE HOME DEATHS PER WEEK (ACTUAL VERSUS ORIGINAL CARTERWOOD FORECAST) (view hi-res version in new tab)

The second wave of deaths in elderly care homes that we originally forecast has not yet come to pass. This is for a number of reasons:

- Exceptional tenacity, strong leadership and superhuman staff: operators responded to the pandemic with incredible speed to implement policies and procedures to protect residents and staff, while care workers themselves have persevered in the most taxing of conditions to deliver exceptional levels of care.

- PPE: use of PPE is now standard, if costly to fund.

- Restricted staff movement between care settings

- Increased testing: even if it is costly and challenging to resource

- Hospital discharges: the mass hospital discharges seen in the early stages of the pandemic have reduced. More stringent measures are in place during the critical admission path.

When it came to closures, we anticipated that, at a local level, homes adversely impacted by COVID-19 would be under intense financial pressure due to significant occupancy reductions, staffing pressures, and the indirect effects of a deep recession. However, in reaching our conclusions we did not anticipate the following:

- Unprecedented fiscal stimulus: the availability of grants and CBILS loans provided a lifeline to all types of businesses across the sector.

- Infection control grants: additional government cash for PPE and other infection control requirements. Some local authorities have also offered void payments for all beds, reimbursement of PPE and agency costs and even one-off payments.

- Bank and lender support: funding to the sector has been unwavering, with lenders prepared to take a medium-term view, given the sector’s importance to the wider health & social care system.

Although the level of government support has prevented closures so far, it’s worth saying that the situation remains perilous for many operators. The fortitude of care operators and their staff has been incredible to witness, but without further short-term funding injections to offset increased costs, and longer-term structural funding reform, we fear that, sadly, there will be an increase in care home closures during 2021.

You can view our updated December 2020 forecasts for the elderly care home sector here.