Earlier this year, Carterwood released new research into elderly care home and bed opening trends, where an interesting regional shift in the areas of focus for investors in the sector was revealed.

For a number of years, the South East has remained the dominant centre of investment; however, in 2020 this region faced competition from the North West and the West Midlands. Both the North West and the West Midlands either equalled or exceeded the number of elderly care home openings in the South East, and each had a higher number of new beds.

Through our market intelligence and working closely with clients, we believe these areas will remain strong in 2021 and beyond, with opportunity for growth and diversification.

Click here to read the full article on this research.

Following on from this research, we decided to explore one of these areas of investment and share our findings with you. In this article, we delve into the West Midlands, revealing prime locations for development, highlighting active developers and operators, we explore planning data and we take a peek at the newest elderly care homes in the market.

This article will form a series of regional spotlights, so be sure to stay tuned for future regional research articles and join us as we examine Great Britain, region by region, uncovering the data we all want to see and highlighting the companies shaking up the market.

Quick links:

- Top locations for development potential (no planning)

- Top locations for development potential (with planning)

- Active developers in the region (2020)

- Operators opening the most care homes in the past 2 years

- Planning overview

- Areas with highest CQC grading by LA

- Newest homes in the market

- Regional overview

- Let’s talk

Prime locations for development potential

With a strong appetite for growth in the West Midlands, we have investigated the prime locations for development across the region, using bed requirement (en-suite) as an indicator of potential. To help identify and rank the areas with the greatest prospects equally, we have chosen to explore these areas from two perspectives: locations with no planning and locations with planning.

Locations with no planning

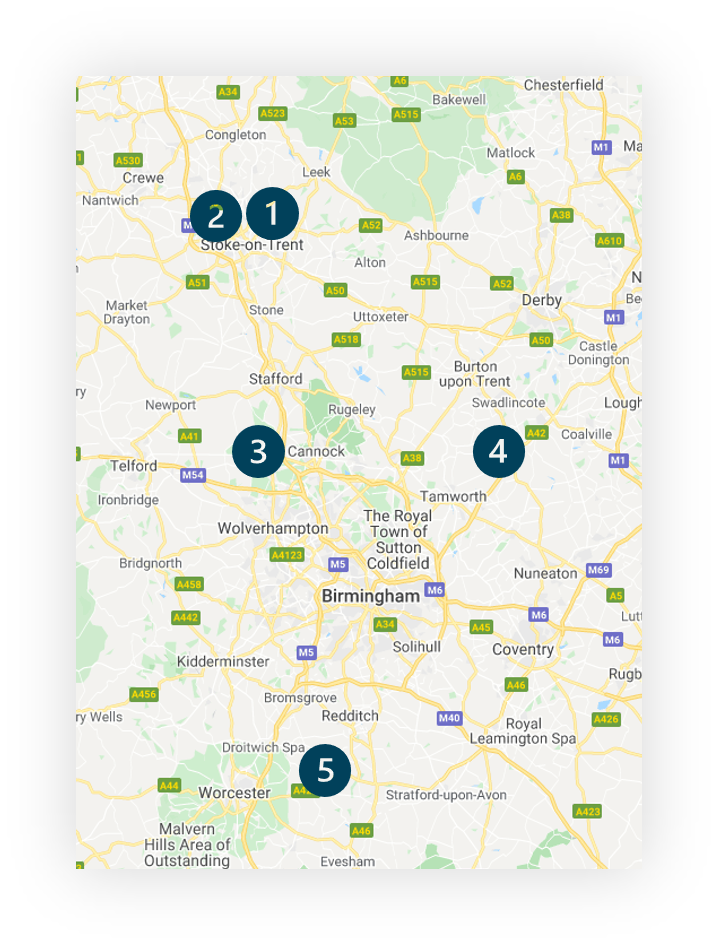

When exploring locations with the most development potential by bed requirements, we can reveal five prime locations with no current planning applications.

Bagnall in Staffordshire is the location with the highest en-suite bed requirement, and with an average house price currently at 17% higher than the national average, shows great potential. However, with strong house prices so important to self-funded referrals, areas such as Madeley Park, with an average house price currently 99% higher than the national average, may present greater prospects.

| Rank | Location | Population 2021 | Care home demand 2021 | En-suite beds | Planned beds | Bed requirement (en-suite) (inc. planning) | Average house price |

|---|---|---|---|---|---|---|---|

| 1 | Bagnall, Staffordshire Moorlands, Staffordshire | 243,080 | 1,295 | 1,061 | 0 | 234 | 289,111 |

| 2 | Madeley Park, Newcastle-under-Lyme, Staffordshire | 58,370 | 414 | 195 | 0 | 219 | 493,218 |

| 3 | Brewood, South Staffordshire, Staffordshire | 74,858 | 512 | 307 | 0 | 205 | 302,537 |

| 4 | Newton Regis, North Warwickshire, Warwickshire | 79,576 | 444 | 280 | 0 | 164 | 315,420 |

| 5 | Inkberrow, Wychavon, Worcestershire | 28,006 | 198 | 43 | 0 | 155 | 374,368 |

Above: Map showing five prime locations with development potential (no planning)

Data notes: Population based on 2021, demand uses regional calculations, town data calculated by a 5-mile buffer around the midpoint of the built-up area (BUA), only includes areas with average house price of least £250k.

Locations with planning

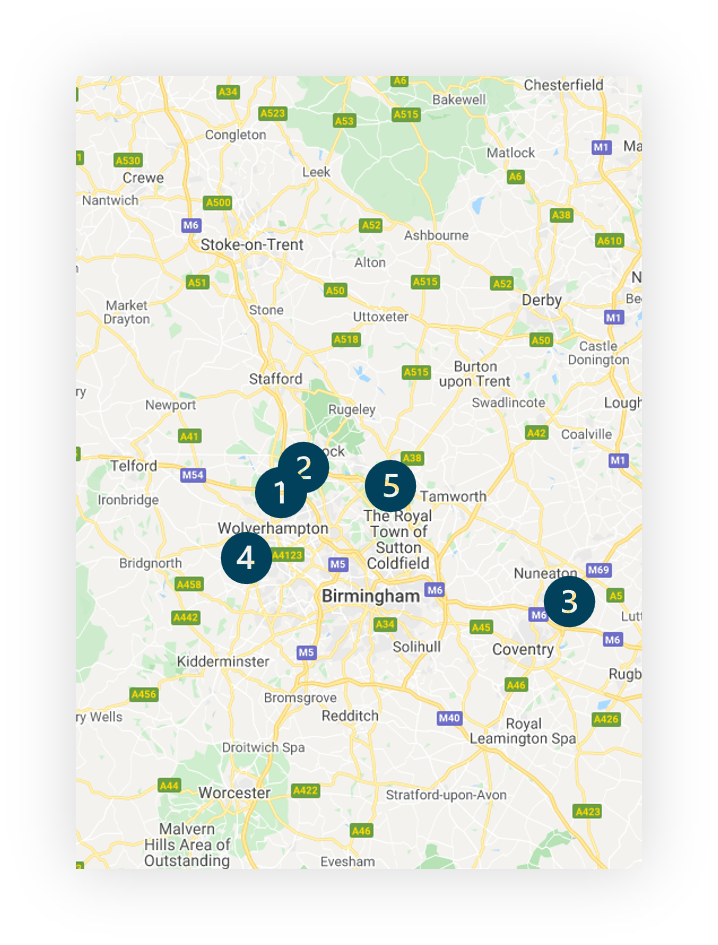

When considering locations with current planning applications (for under 200 planned beds), we can reveal five prime locations with high development potential by bed requirement.

Springhill in South Staffordshire strongly leads the way with an en-suite bed requirement some 245 beds greater than the second ranking location of Shareshill. However, it is again worth highlighting that the location with the highest bed requirement is also the area with the lowest average house price, signalling those areas in lower ranking positions with lower bed requirements but with higher average house prices may offer better development potential for care homes operating a self-funded model.

| Rank | Location | Population 2021 | Care home demand 2021 | En-suite beds | Planned beds (pending and granted) | Bed requirement (en-suite) (inc. planning) | Average house price |

|---|---|---|---|---|---|---|---|

| 1 | Springhill, South Staffordshire, Staffordshire | 425,103 | 2,159 | 1,444 | 91 | 624 | 285,182 |

| 2 | Shareshill, South Staffordshire, Staffordshire | 312,249 | 1,679 | 1,143 | 157 | 379 | 298,902 |

| 3 | Bramcote, Rugby, Warwickshire | 195,601 | 1,121 | 678 | 101 | 342 | 299,995 |

| 4 | Himley, South Staffordshire, Staffordshire | 359,081 | 2,279 | 1,829 | 146 | 304 | 327,170 |

| 5 | Stonnall, Lichfield, Staffordshire | 251,948 | 1,706 | 1,275 | 150 | 281 | 334,065 |

Above: Map showing five prime locations with development potential (with planning)

Data notes: Population based on 2021, demand uses regional calculations, town data calculated by a 5-mile buffer around the midpoint of the built-up area (BUA), only includes areas with average house price of least £250k.

Developer focus

The West Midlands boasts a wide range of developers, from national leaders to regional players. Here we take a moment to highlight two developers who have been among the most active in the region over the course of 2020. Together, they plan to deliver over 400 beds to the market across 6 care homes and are pressing ahead with development.

- Number of elderly care home beds: 211

- Applications validated: 2

- Applications granted: 1

- of care home beds per application: 61–75

We congratulate Cinnamon Care Collection on launching their newest additions to the care home market in the West Midlands.

Parkfield Grange, Stourbridge

Eastcote Park, Solihull

Sutton Park Grange, Sutton Coldfield– opening July 2021

- Number of care home beds: 198

- Applications validated: 2

- Applications granted: 2

- of care home beds per application: 66

We congratulate LNT Care Developments on introducing these new care homes to the West Midlands market.

Kidderminster, Worcester

Redditch, Worcestershire

This data is based on all care home applications for new beds validated and/or granted between 01/01/20 and 31/12/20, including new builds and extensions. The top developers have been chosen as those with the applications for the most total beds (validated and/or granted).

Please contact us to find out more about planning applications in the region.

Care home opening leaders

The West Midlands is home to a variety of elderly care home operators, many of which are specific to the region. We take this opportunity to celebrate those who have opened care homes within the last 2 years.

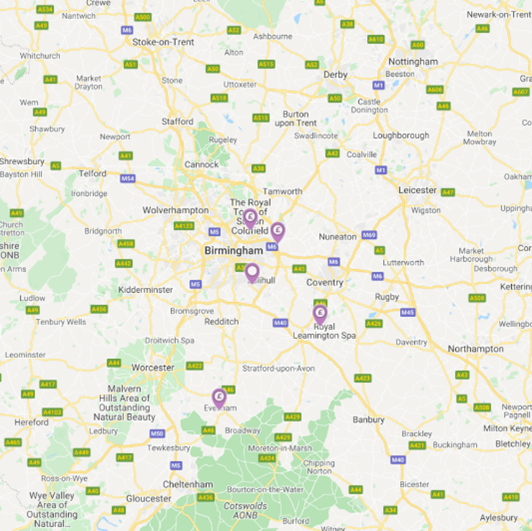

Operators who have opened 3 homes

No. of care homes (GB): 5

No. of beds (GB): 406

Operating region: West Midlands

Above: Restful Homes Group elderly care home locations

Source: Carterwood Analytics

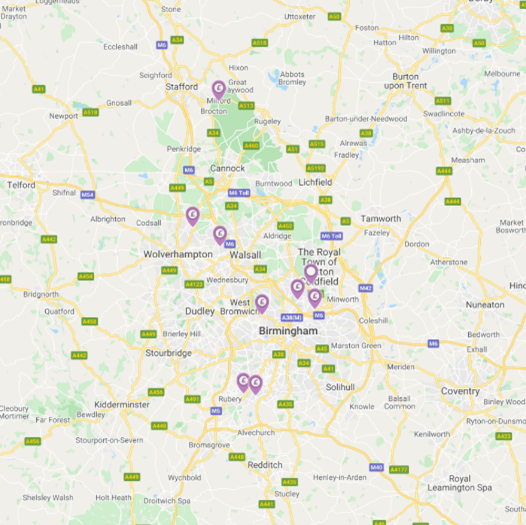

No. of care homes (GB): 9

No. of beds (GB): 612

Operating region: West Midlands

Above: MACC Care care elderly care home locations

Source: Carterwood Analytics

Operators who have opened 1 home

- Barchester Healthcare Ltd

- Absolute Care Homes (Central) Ltd

- Avery Healthcare Group

- Ideal Carehomes Ltd

- Prime Life Ltd

- Superior Care (Midlands) Ltd

- Borough Care Ltd

- Majesticare

- Crosscrown Ltd

- Dormy Care Communities

- Maria Mallaband Care Group Ltd

- Richmond Villages

- Runwood Homes Ltd

- Taylor & Taylor Ltd

This includes only new homes that were registered with the CQC between 01/04/19 and 01/04/21.

Planning overview

Here we take a look at the planning applications, both validated and granted, within 2020.

Some interesting points to highlight:

- 60% of planning applications validated were for extensions, compared to 40% for new builds

- 9 is the average number of beds for granted extension applications, compared to 13.4 for validated extension applications

- 61 is the average number of beds granted for new build applications

| West Midlands care home applications (2020) | Total (no. of applications) | Total (no. of beds) | New-build (no. of applications) | New-build (no. of beds) | Extensions (no. of applications) | Extensions (no. of beds) |

|---|---|---|---|---|---|---|

| Validated | 45 | 1,489 | 18 | 1,126 | 27 | 363 |

| Granted | 26 | 839 | 11 | 676 | 15 | 163 |

This data is based on all care home applications for new beds validated and/or granted between 01/01/20 and 31/12/20.

West Midlands local authority areas with highest CQC grading

With outstanding and good CQC scores aggregated, the local authority of Worcester ranks as the area with the highest CQC grading, followed by Telford and Wrekin, and Wyre Forest. Across the West Midlands, 3% of homes are rated outstanding, with 66% rated good by the CQC.

| Overall rank | Local authority | Outstanding (%) | Good (%) | Requires improvement (%) | Inadequate (%) |

|---|---|---|---|---|---|

| 1 | Worcester | 8.3 | 83.3 | 8.3 | 0 |

| 2 | Telford and Wrekin | 4.5 | 86.4 | 9.1 | 0 |

| 3 | Wyre Forest | 4.3 | 78.3 | 17.4 | 0 |

| 4 | Bromsgrove | 6.5 | 71 | 22.6 | 0 |

| 5 | Newcastle-under-Lyme | 0 | 85.7 | 14.3 | 0 |

| 6 | South Staffordshire | 0 | 77.3 | 13.6 | 0 |

| 7 | Shropshire | 4 | 76 | 14.7 | 4 |

| 8 | Stratford-on-Avon | 6.9 | 65.5 | 24.1 | 0 |

| 9 | Birmingham | 3.3 | 71.7 | 22.5 | 1.7 |

| 10 | Herefordshire, County of | 11.1 | 62.2 | 24.4 | 0 |

Total scores for each local authority may not add to 100% as unrated homes are not included.

Ranking process: Areas with the highest overall proportion of outstanding and good homes, and the lowest overall proportion of requires improvement and inadequate homes are ranked the highest, with the following methodology applied: (outstanding + good) – (requires improvement + inadequate).

Newest homes in the market

After a year like no other, here we celebrate the developers and operators who have triumphed over adversity to open care homes in 2020/2021. In particular, we congratulate Restful Homes Group who have succeeding in opening a total of three homes during this period.

- Hen Cloud House operated by Borough Care Ltd

Buxton Road, Leek, ST13 6EQ

Registered: 17/03/2021

- Connaught House operated by Restful Homes Group

The Green, Stratford Road, Solihull, B90 4LA

Registered: 18/12/2020

- Sedgley Court operated by Ideal Carehomes Ltd

Brick Kiln Way, Gospel End, Dudley, DY3 4BA

Registered: 10/12/2020

- Sutton Rose Care Home operated by MACC Care Ltd

St Michaels Road, Boldmere, Sutton Coldfield, B73 5SG

Registered: 07/12/2020

- Droitwich Mews Care Home operated by Avery Healthcare Group

Mulberry Tree Hill, Droitwich, WR9 7SS

Registered: 16/10/2020

190 Commonside, Brierley Hill, DY5 4AA

Registered: 13/10/2020

1355 Stratford Road, Shirley, Solihull, B90 4EF

Registered: 13/05/2020

- Castlehill Specialist Care Centre operated by Restful Homes Group

390 Chester Road, Walsall, WS9 9DE

Registered: 30/03/2020

Newbury Lane, Oldbury, B69 1HF

Registered: 28/01/2020

- Lanesborough House Care Home operated by Restful Homes Group

Birmingham Road, Coleshill, Birmingham, B46 1DJ

Registered: 16/01/2020

Homes are listed in order of the date the home was registered with the CQC.

Regional Overview

When comparing the West Midlands to other regions throughout the UK, it is in many ways in line with other regions when it comes to average home size, asset quality and type of care .

| Region | Elderly beds | Number of homes | Average home size (beds) | Wetroom (%) | En-suite (%) | Pre 1990 (%) | Top assets (%) | N (%) | DE (%) | Outstanding CQC rating (%) | Good CQC rating (%) | Average age (years) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| South East | 70,533 | 1,690 | 42 | 37 | 78 | 49 | 20 | 44 | 25 | 5 | 72 | 29 |

| North West | 55,382 | 1,343 | 41 | 18 | 63 | 40 | 11 | 38 | 24 | 3 | 74 | 29 |

| South West | 46,884 | 1,232 | 38 | 30 | 75 | 49 | 14 | 38 | 23 | 7 | 76 | 30 |

| East of England | 44,480 | 982 | 45 | 30 | 79 | 37 | 18 | 32 | 23 | 7 | 70 | 27 |

| Yorkshire and The Humber | 40,596 | 914 | 44 | 24 | 70 | 33 | 15 | 33 | 21 | 3 | 70 | 26 |

| West Midlands | 40,456 | 945 | 43 | 32 | 74 | 39 | 18 | 42 | 23 | 3 | 66 | 27 |

| Scotland | 36,736 | 811 | 45 | 33 | 84 | 25 | 22 | 61 | 16 | - | - | 25 |

| East Midlands | 36,691 | 901 | 41 | 25 | 65 | 32 | 14 | 36 | 18 | 3 | 67 | 26 |

| London | 27,705 | 570 | 49 | 32 | 84 | 36 | 21 | 55 | 27 | 3 | 75 | 28 |

| North East | 23,113 | 480 | 48 | 15 | 80 | 20 | 10 | 46 | 28 | 5 | 82 | 24 |

| Wales | 21,903 | 618 | 35 | 13 | 55 | 26 | 8 | 36 | 21 | - | - | 29 |

| Northern Ireland | 14,413 | 340 | 42 | 17 | 43 | 16 | 11 | 64 | 26 | - | - | 26 |

| Channel Islands | 1,718 | 48 | 36 | 26 | 82 | 13 | 19 | 46 | 8 | - | - | 23 |

| Isle of Man | 1,029 | 25 | 41 | 33 | 84 | 12 | 16 | 40 | 13 | - | - | 28 |

Note: Top assets refers to the percentage of homes with a prime or super-prime rating. The percentage of homes that opened pre-1990 does not take into account homes where we do not know the age, which tend to be older homes, so the actual percentage of homes that opened pre-1990 may be higher than this. N refers to nursing care and DE refers to dedicated dementia care.

Let’s talk

If you are interested in developing in the West Midlands and would like to discuss our research and receive the full data for this regional spotlight, we would be delighted to hear from you.

Our team of sector specialists are here to support your growth plans, providing expert market intelligence, advice and guidance at every step of your journey.

- Find out more about our advisory services

- Discover how Carterwood Analytics – our online platform for care home market analysis – can help you

Speak to Tom Hartley, director at Carterwood, on how we can help you reach your potential – email info@carterwood.co.uk or call 01454 838038.