This is the final article in our series of four that delve into Carterwood’s updated and significantly expanded research into the self-funded fee rates charged by over 9,000 elderly care homes across Great Britain. This week we explore the existence of what’s known as a ‘dementia premium’.

Read the other articles in this series:

- Self-funded fees by geography

- Self-funded fee breakdown by CQC rating

- Self-funded fee breakdown by year of first-registration

If you would like to request a copy of our full research report in PDF format, please contact Tom Hartley (director) on tom.hartley@carterwood.co.uk or 07715 495062.

Dementia premium

To assess the level of dementia premium across Great Britain, we have looked at all homes that provided separate fee rates for both general elderly frail and for dementia care. We have only assessed homes that quote both rates to provide the most accurate results; this reduces the sample size but provides more meaningful analysis.

| Basis of assessment | Nursing DE vs OP differential (%) | Personal care DE vs OP differential (%) | Nursing sample size | Personal care sample size |

|---|---|---|---|---|

| All homes providing a fee for both DE and OP care categories | 1.1% | 1.9% | 2,470 | 5,032 |

| All homes with a dedicated dementia unit (inclusive of homes that charge the same for DE and OP) | 1.4% | 3.2% | 1,201 | 1,481 |

| All homes with a dedicated dementia unit (exclusive of homes that charge the same for DE and OP) | 4.5% | 7.6% | 355 | 618 |

Table 1 – Fee differential analysis for dementia care

The table above illustrates the level of dementia premium across three bases of assessment:

- The first shows the global uplift for all homes registered for OP and DE.

- The second looks at the premium for homes where there is a specialist dementia unit within a larger care home – the premium is slightly larger here as we would expect homes that are unitised to be either differentiating their services or providing care to a higher level of dependency in specialist units.

- The third measure looks at the level of uplift for homes that have specialist dementia units and that differentiate their fees (i.e. excluding homes that charge the same fee for OP & DE clients). The uplifts here are much higher, particularly for personal care dementia, and indicate that where operators do differentiate their product offering or where more specialised services can be provided there is the prospect of material fee increases.

There is consistently a greater premium attached to personal care dementia than nursing care dementia. We consider that this is due to the greater likelihood of co-morbidities in nursing patients, potentially making dementia care requirements secondary or equivalent to underlying physical frailty or other conditions and driving less of a premium.

Conversely, for personal care dementia, the level of challenge can often be greater as the physical frailty is less and dementia symptoms are more dominant, requiring higher staffing levels and better training.

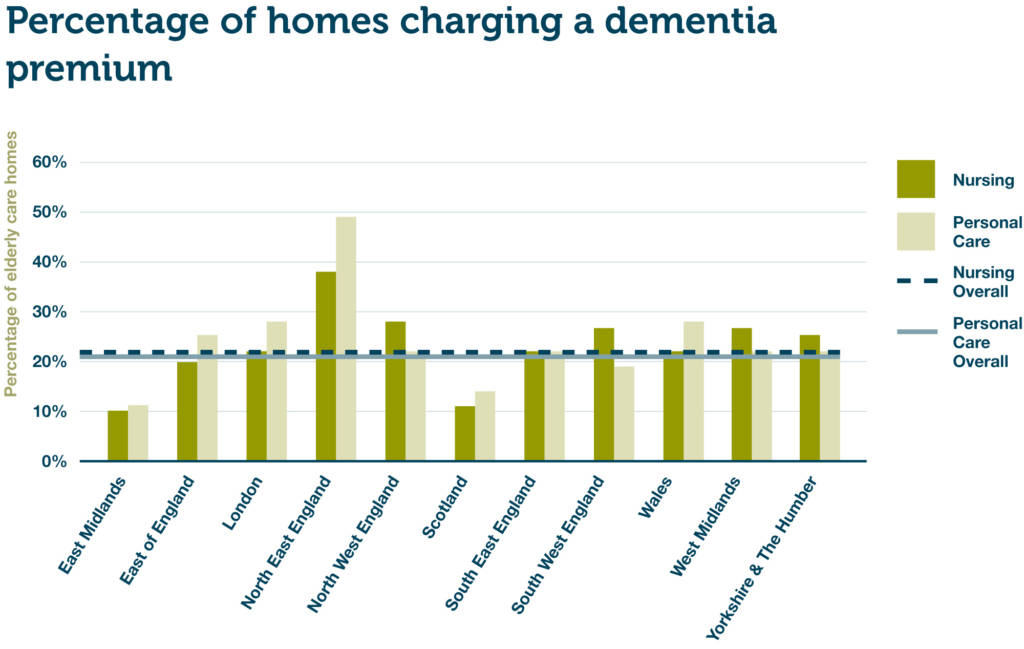

We also wanted to see what proportion of nursing and personal care homes charge a premium for dementia care, so we have broken that down by country/region.

Figure 1 – Percentage of elderly care homes that charge a premium for dementia care.

The existence of a dementia premium has been long established in the minds of operators, but our data shows considerable variation across care categories and countries/regions. Overall, 22% and 23% of elderly care homes providing nursing and personal care, respectively, charge a premium for dementia care over general elderly frail rates where they are registered for both care categories.

The proportion of nursing care homes charging a premium has remained unchanged since our initial research, but the proportion of personal care homes charging a premium has reduced considerably, down from 31% to 23% of all homes.

Our initial research in July excluded homes of less than 30 beds, which in this expanded dataset now make up a significant proportion of homes. These homes do not have the same ability as their larger counterparts to differentiate their fee rates in a non-unitised/specialist environment. This is the most likely explanation for the decrease in the proportion of personal care homes charging a premium, despite some of the newly added regions to the dataset (the North East in particular) having an overall very large proportion of homes that charge a dementia premium.

Background to this research

The COVID-19 pandemic has exacerbated a series of historic challenges facing the adult social care sector and, despite reacting quickly and effectively to minimise the impact from the virus, operators are still burdened by increased costs, below-average occupancy rates, and the long-standing lack of a reformed legislative framework to fix the funding of long-term care.

If our sector is going to be able to adapt to the challenges it faces now and prosper in the future, the robustness of the self-funding market remains central to its long-term viability given the consistently disappointing fee rates on offer from all but a handful of local authorities. We believe that access to accurate self-funded fee data is essential in helping care homes to benchmark their fees and make their businesses more resilient at this challenging time.

Our self-funded fees dataset covers 9,000+ homes, equating to 89% of the elderly care homes in Great Britain that accept self-funded referrals. The breadth and depth of this dataset is unrivalled, and all fee rates have been collected since May 2020. This enables us to demonstrate the self-funded fee dynamics at play across Great Britain with remarkable clarity.

To discuss our research in more detail, or to find out more about getting access to our comprehensive fee data via Carterwood Analytics, contact Tom Hartley (director) on tom.hartley@carterwood.co.uk or 07715 495062.

Overall key findings

- The average GB nursing self-funded fee rate is £1,142 p/w.

- The average GB personal care self-funded fee rate is £860 p/w.

- Care homes in England with an Outstanding CQC rating have on average 20.6% higher self-funded fee rates compared to homes rated Good. However, there is comparatively little difference between English homes rated across other CQC grades and there is, on balance, no difference in self-funded fee rates between a home rated as Requires Improvement and one that is rated Inadequate.

- Care homes in the South East charge the highest average self-funded nursing care fee rates at £1,339 p/w. All countries and regions, except North East England and Wales, achieve average self-funded fees of over £1,000 p/w for nursing care.

- As expected, across all countries and regions there is a strong correlation between age of home and self-funded fee rates. Homes registered since 2010 charge on average 12.8% and 11.2% more than homes registered between 2000–2009 for nursing and personal care, respectively.

- Overall, 22% and 23% of nursing and personal care self-funded fee rates, respectively, show a premium for dementia care over general elderly frail rates where homes are registered for both care categories.

- Fees for nursing care dementia are on average 1.1% higher than standard older people’s nursing care, and personal care dementia fees are 1.9% higher than those for standard personal care. Where homes have specialist dementia units in larger mixed registration homes and differentiate fee rates, the premiums are significantly higher at 4.5% and 7.6%, for nursing and personal care, respectively.

The need for quality data

Professor Martin Green, chief executive – Care England

“The social care sector is under more pressure now than ever before and there is an acute need for high-quality data that can help operators adapt to the changes in the market. Carterwood’s comprehensive self-funded fee rate research gives operators clarity when it comes to benchmarking their fees at a time when maximising income has never been more pressing.”

Vic Rayner, executive director – National Care Forum

“Access to good quality data is essential for each and every care home provider as they seek to navigate this turbulent period. As providers struggle to find the time to carry out essential benchmarking activity, Carterwood have once again proved themselves to be a vital partner to the care sector by bringing together important data on care home fees in this important and impactful report.”

Access accurate self-funded fee data for 9,000+ elderly care homes with Carterwood Analytics

Carterwood Analytics is now home to the most comprehensive self-funded fee dataset available, with coverage of 94% of the self-funded elderly care home market.

- Explore the competition list to view fee information for all homes in your catchment area. Sort homes by minimum and maximum fees for nursing and personal care, and filter the homes in the catchment to make more meaningful comparisons.

- Use our powerful new fee analyser feature to break down self-funded fee rates by date of first registration, CQC rating and ownership of home, as well as by category of care, then benchmark your catchment area against region, Great Britain as a whole, or against the entire portfolio of a specific operator.

Find out more about Carterwood Analytics here, or email sales@carterwoodanalytics.co.uk to book a demo.